All Categories

Featured

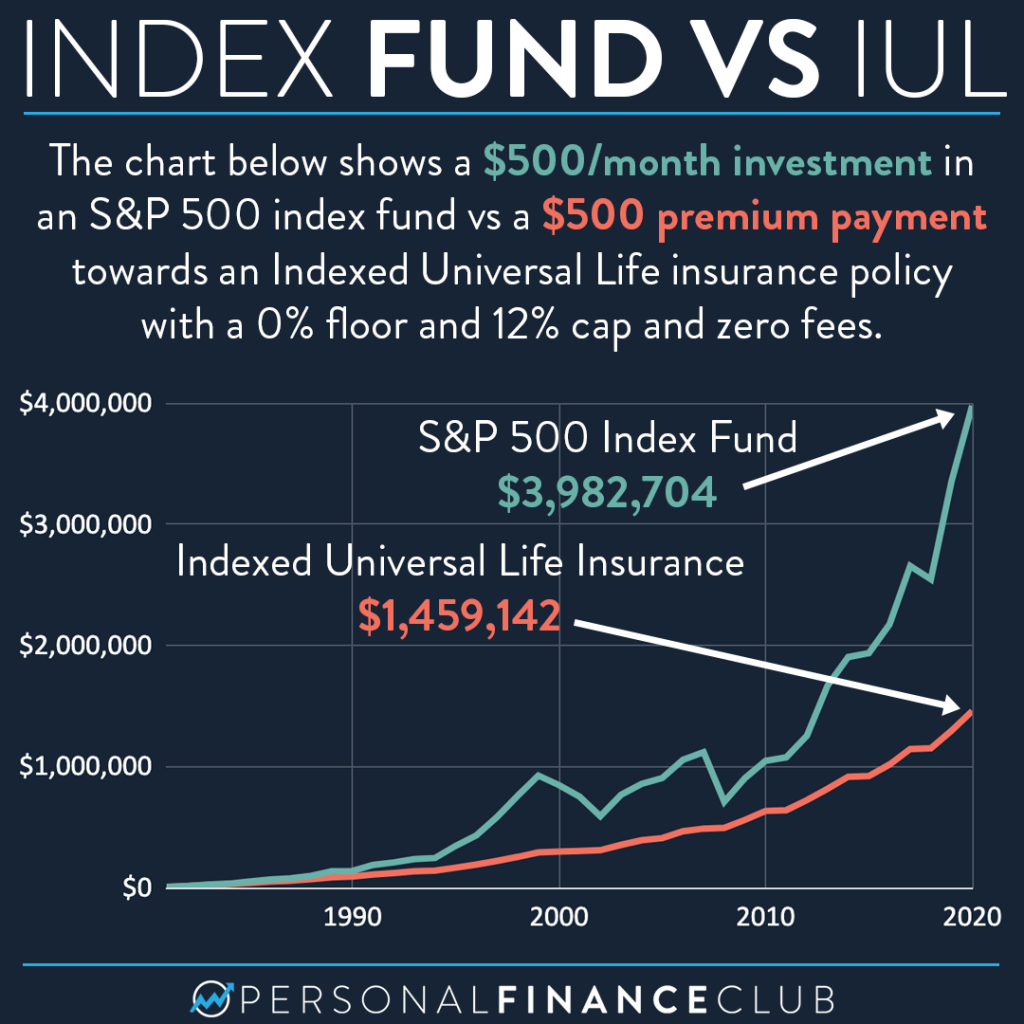

If you're mosting likely to utilize a small-cap index like the Russell 2000, you might desire to pause and consider why an excellent index fund firm, like Vanguard, doesn't have any kind of funds that follow it. The factor is because it's a lousy index. And also that altering your whole policy from one index to another is rarely what I would call "rebalancing - index universal life insurance canada." Cash worth life insurance isn't an appealing asset class.

I haven't even addressed the straw guy right here yet, which is the reality that it is relatively rare that you in fact need to pay either tax obligations or considerable payments to rebalance anyhow. I never ever have. The majority of smart financiers rebalance as high as possible in their tax-protected accounts. If that isn't fairly adequate, early accumulators can rebalance simply utilizing new payments.

Best Universal Life Insurance

Decumulators can do it by withdrawing from asset courses that have succeeded. And naturally, no one needs to be getting packed shared funds, ever. Well, I hope articles like these help you to see through the sales tactics often utilized by "monetary specialists." It's really as well poor that IULs don't function.

Latest Posts

Equity Indexed Universal

Iul Explained

Universal Life Insurance For Seniors